Boohoo, one of many UK’s most distinguished vogue ecommerce corporations, have launched their newest outcomes.

Income has bumped up from slightly below £200 million final yr, to simply below £300 million yr ended twenty eighth Feb 2017 (51% up). Gross revenue is up by 42% (£160m vs £112m), and working revenue has properly doubled too.

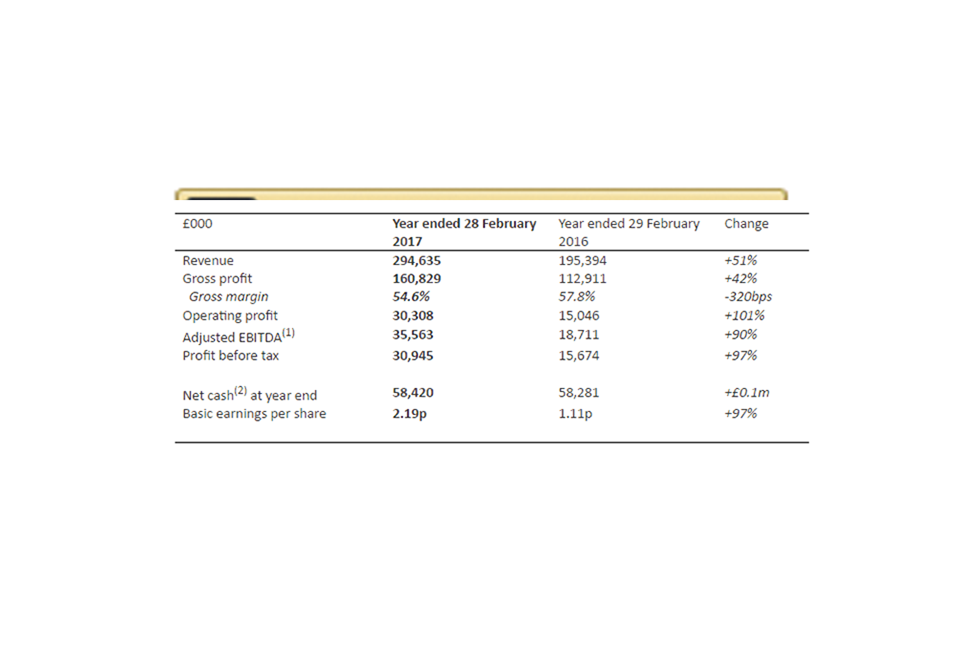

The complete numbers, direct from Boohoo, are:

They’ve carried out many attention-grabbing actions over the past yr, most notably:

- Buying the IP of Nasty Gal – the massively well-known US teen/early 20s ladies’s vogue etailer backed by Index Ventures amongst others.

- Buying majority curiosity in PrettyLittleThing (1.3 million lively prospects)

- Prolonged their warehouse, invested in warehouse & buyer assist employees.

- Launched UK, USA, Australia apps; gone responsive throughout their European websites (they now report cellular/pill make up >70% of periods)

- Expanded product ranges (now at greater than 29,000 types)

Because of all of this exercise, the numbers have jumped up massively over the past yr, underpinned by some core metrics:

- Boohoo prospects are as much as 5.2 million actives inside the yr.

- Periods on-site are at 249 million for the yr (21% up on final yr).

- Order frequency has marginally elevated (2.1 orders per buyer inside the 12 months)

- Conversion from go to to sale has leapt from 4.0% to 4.4% – not one thing that’s simple to do whereas quickly growing periods.

A few of these enhancements are credited to the expanded & training-invested Buyer Help group; some right down to supply proposition which is quick and tremendous handy:

“boohoo prospects are ready to select from a variety of supply choices, which we’re continually refining as new alternatives turn out to be out there. We function a midnight cut-off for subsequent day supply, Sunday supply and gather+ returns within the UK. Within the second half of the yr we launched boohoo Premier, which provides a vast subsequent day supply service within the UK for an annual price, and has obtained a really beneficial buyer response.”

Right here’s a full abstract of the KPI motion from 2016 to 2017: