In “China Is Dominating Ecommerce,” contributor Marcia Kaplan addressed that nation’s innovation in on-line procuring. Digital funds in China are equally progressive. I’ll handle what that might imply for North American retailers on this put up.

Lesson 1: Excessive Charges

Excessive credit-card charges encourage retailers to search for alternate options. Decrease charges drive income and investments.

Take into account the typical charges a service provider in China can anticipate to pay for processing three common cost strategies.

- WeChat Pay, the most well-liked cost methodology, is accepted by 72 million retailers in China and claims to course of over 1 billion transactions day by day. WeChat Pay’s common service provider processing charge is 0.6 p.c.

- Alipay, China’s second hottest cost app with utilization statistics much like WeChat Pay, has a median service provider charge of 0.55 p.c.

- China Union Pay, China’s hottest bank card, has a median service provider charge of 0.8 p.c.

The common card-present charge in North America is roughly 2.2 p.c; card-not-present is roughly 3.5 p.c. Thus the distinction is obvious: North American retailers are paying much more to course of fewer transactions. (There are roughly 100 million each day bank card transactions within the U.S. versus 1 billion in China.)

To make sure, the unbelievable progress of ecommerce and cell funds in China can’t be attributed completely to cheap transaction charges. Nonetheless, if charges in China have been much like these in North America, adoption would presumably be a lot decrease.

Excessive service provider charges might finally immediate North American retailers to:

- Search alternate options to card-based funds. An instance is the Starbucks cell pockets. Clients load funds into their accounts and use these funds (plus loyalty-based rewards) to pay for purchases. The saved funds permit Starbucks to keep away from interchange and card-assessment charges on each buy. Anticipate different retailers to undertake their very own stored-value wallets and reloadable present playing cards.

- Name for extra regulation on card manufacturers (Visa, Mastercard, American Specific, others), together with extra antitrust lawsuits.

- Undertake inexpensive cost strategies, reminiscent of debit playing cards, direct-from-bank funds, and peer-to-peer funds.

Lesson 2: Client Credit score-card Debt

Crushing bank card debt causes customers to search for alternate options.

Bank card debt is as a lot of an issue in China as in North America. In 2020, Chinese language cardholders accrued roughly $2.5 trillion of bank card debt; People accrued $930 billion.

In 2019, recognizing the danger of bank card debt to the nation’s economic system, the Chinese language authorities capped bank card rates of interest at 12 to 18 p.c, relying on the kind of card. These charges are roughly in keeping with North America.

Nonetheless, extreme debt continues to plague customers in China and North America, which might drive consumers to “debt-free” alternate options, reminiscent of:

- Debit playing cards and direct-from-bank funds, which permit customers to make purchases provided that ample funds are of their account. Retailers ought to anticipate extra debit card funds and extra bank-based funds.

- Purchase-now-pay-later, whereas nonetheless a type of credit score, might assist customers handle their debt. Regardless of the comparatively excessive charges, retailers are accepting BNPL funds as consumers are in search of alternate options to card-based debt.

- Pay as you go playing cards, which might acquire wider acceptance as a result of they act like bank cards however don’t permit customers to pay with cash they don’t have.

Lesson 3: Level-of-sale {Hardware}

In China, cost apps reminiscent of WeChat Pay and Alipay use QR codes. A reported 98 p.c of city Chinese language customers use their digital pockets for each day purchases. Most customers don’t carry money.

The result’s that Chinese language retailers aren’t burdened by costly registers and point-of-sale gear. Retailers merely show QR codes for patrons to scan.

North American brick-and-mortar retailers might scale back gear prices by implementing QR code-initiated funds, reminiscent of from PayPal and Sq..

Lesson 4: Tremendous Apps

In China, leisure, procuring, social media, funds, and extra are mixed in “tremendous apps” — usually WeChat. Chinese language customers use one app for:

- Web browsing,

- Information consumption,

- Chat messaging,

- Funds and cash transfers,

- Procuring,

- Social media,

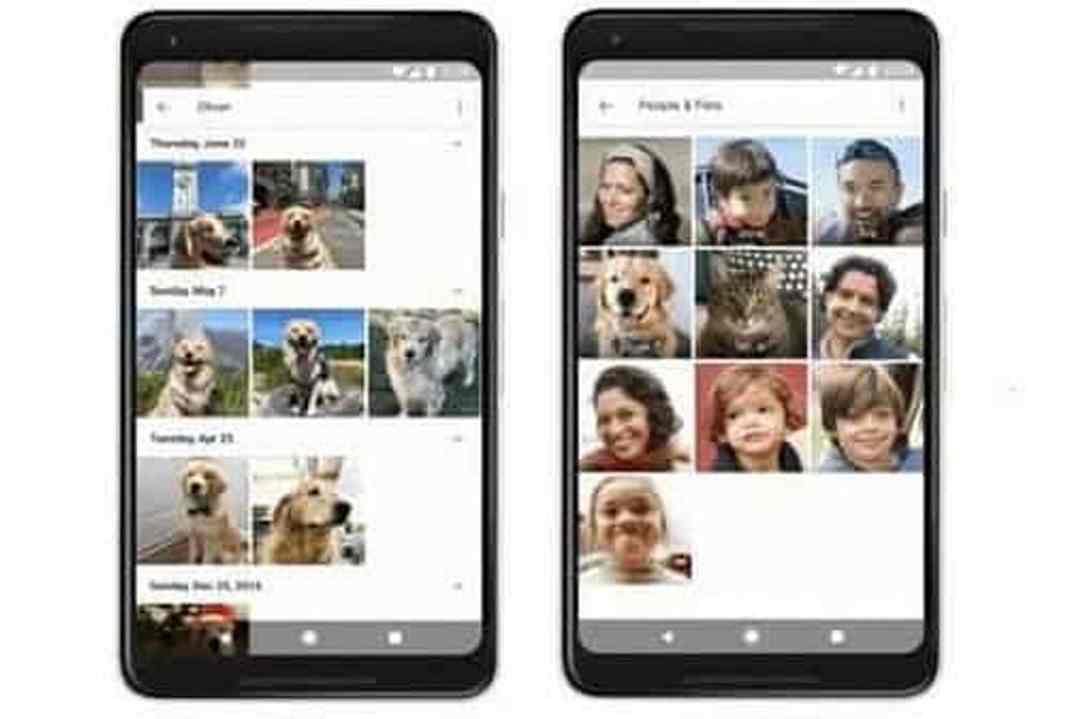

- Picture sharing,

- Gaming,

- Leisure.

North American customers use a single app for one or two functions, usually. An instance is Instagram for sharing photos. Solely just lately has Instagram expanded into procuring and cost acceptance. Maybe Amazon will evolve into tremendous app standing by combining leisure with procuring.

Regardless of the political rhetoric within the U.S. to interrupt up Large Tech, retailers ought to carefully monitor the emergence of tremendous apps. In the event that they turn into wherever close to as common as in China, these apps might assist retailers attain huge audiences.