Stablecoin and central financial institution digital currencies might supply the advantages of shopping for and promoting with cryptocurrencies with out the worrisome value swings.

Blockchain-driven transactions may benefit the ecommerce business. Transaction charges must be low in the event that they exist in any respect. Fraudsters could be flustered. Even shoppers with out financial institution accounts and bank cards may store on-line.

However absent fluctuations in worth, crypto funds are usually not possible for many retailers.

Stablecoin

Stablecoin is a cryptocurrency. However not like Bitcoin or Ethereum, stablecoin has a set trade charge tied to an exterior reference, such because the U.S. greenback, the euro, or a commodity, say gold or silver.

Stablecoins are issued by personal firms however work like governments, increasing or contracting the cash provide to keep up mounted trade charges.

Within the case of a stablecoin pegged to the U.S. greenback, the issuing firm or group would hopefully maintain at the very least as many U.S. {dollars} as there are models of the stablecoin in circulation. If there was a run on the stablecoin, the issuer may due to this fact trade them for {dollars}.

Stablecoin has a set trade charge tied to an exterior reference, such because the U.S. greenback or the euro. Tether, among the many hottest stablecoins, is pegged to the greenback.

CBDC

Central financial institution digital currencies are a public sector various to stablecoins.

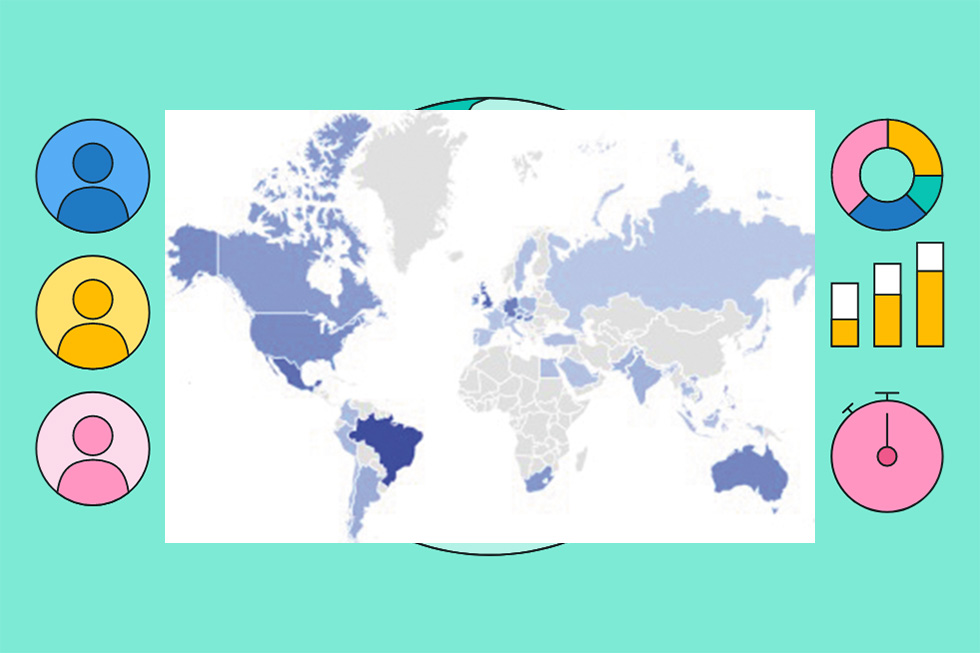

China, Sweden, The Bahamas, Marshall Islands, and the Japanese Caribbean Forex Union have all launched CBDCs for retail transactions.

In every case, the ledger or blockchain used to document and confirm transactions is government-controlled, involving a central financial institution.

Thus a CBDC must be simply as secure and secure as that authorities’s fiat foreign money, and a service provider or shopper may trade a CBDC in confidence.

A number of different nations are reportedly contemplating a retail CBDC. Once more, these digital currencies may have the advantages of cryptocurrencies and the soundness of, say, U.S. {dollars}.

Stability

Stability is necessary. Take into account this instance. In Might 2010, a programmer named Laszlo Hanyecz paid 10,000 Bitcoin for a pair of Papa John’s giant pizzas. On the time, Hanyecz was getting an actual deal. The ten,000 Bitcoin had a road worth of about $10. The pair of pizzas have been price double that.

Quick ahead to October 12, 2021, and 10,000 Bitcoin are price greater than $562 million. That’s insane volatility.

It’s little marvel retailers are involved. Promote a widget for a tiny proportion of a Bitcoin, trade it for a handful of {dollars}, and tomorrow you may miss out on a fortune — or vice versa.

Property

Tether is arguably the most well-liked stablecoin on the earth. In October 2021, it had a market capitalization of virtually $70 billion. And Tether is pegged to the U.S. greenback.

If Tether or comparable stablecoins are for use in ecommerce, retailers and consumers should really feel snug holding it in order that its worth and the U.S. greenback are in lockstep.

Critics have questioned Tether’s asset base. They argue that Tether’s holdings are usually not enough or seen sufficient to make it reliable.

Tether has responded by opening up its books.

Satirically, the controversy round Tether would possibly hasten its use in on-line transactions.

Involved about what would occur to a reference foreign money if a stablecoin failed, some governments, together with the U.S., have began to contemplate regulating stablecoin.

That regulation may take away a few of the benefits of utilizing a stablecoin for on-line transactions. However it may additionally construct shopper confidence.

See “Stablecoin, CBDCs May Enhance Ecommerce.”